Forex Trading Signals in India: An In-Depth Guide

Forex trading has gained substantial popularity in India over the past decade. As more individuals and institutions engage in the currency markets, the need for accurate and reliable trading signals has become paramount. This blog explores the concept of Forex trading signals[1], their importance, types, and how they can be utilized effectively in India.

What are Forex Trading Signals?

Forex trading signals[2] are recommendations or suggestions that indicate the optimal times to buy or sell currency pairs in the Forex market. These signals can be based on various factors, including technical analysis, fundamental analysis, or a combination of both. They help traders make informed decisions and also potentially enhance their trading performance

Importance of Forex Trading Signals

- Informed Decision Making: Signals provide traders[3] with insights based on expert analysis, reducing the need for constant monitoring and analysis of the markets.

- Time-Saving: By following reliable trading signals, traders can save significant time that would otherwise be spent on market research and analysis.

- Educational Value: For beginners, trading signals can serve as an educational tool, helping them understand market dynamics and trading strategies.

- Reduced Emotional Trading: Signals can help traders avoid making impulsive decisions driven by emotions, which often lead to losses.

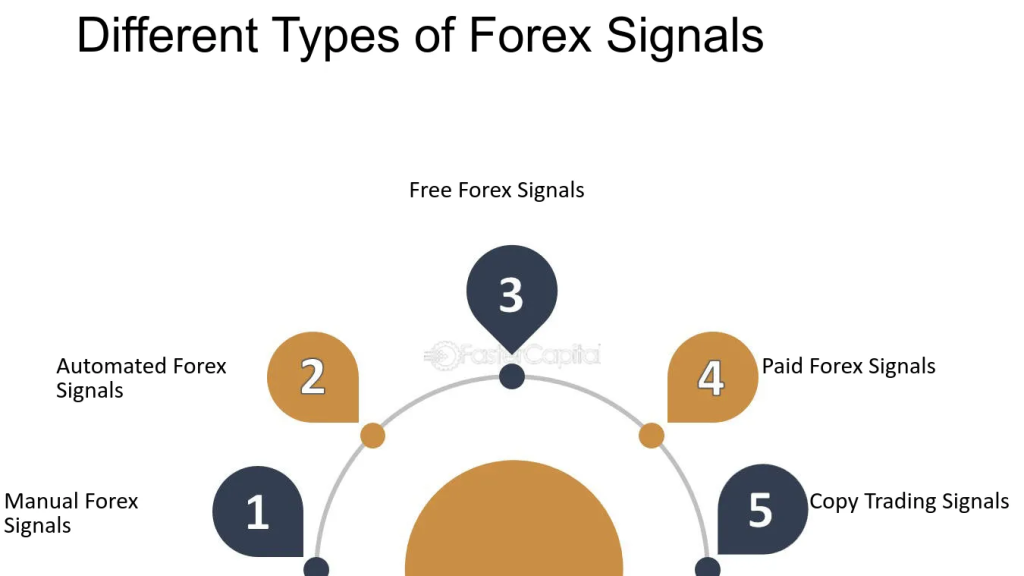

Types of Forex Trading Signals

- Manual Signals: These are generated by professional traders or analysts who manually analyze the market conditions and send out trading recommendations.

- Automated Signals: Generated by algorithms and trading robots, these signals are based on pre-defined criteria and technical indicators. They can execute trades automatically or send alerts to traders.

- Copy Trading: This involves copying the trades of experienced[4] and successful traders. Platforms like ZuluTrade and eToro offer copy trading services where traders can mirror the trades of top performers.

- Subscription-Based Signals: Many service providers offer trading signals on a subscription[5] basis. Traders can receive these signals via SMS, email, or through dedicated trading platforms and apps.

How Forex Trading Signals Work

Forex trading signals generally and typically include the following key components:

- Entry Point: The price level at which the trader should enter the trade.

- Exit Point: The price level at which the trader should close the trade.

-

Stop Loss: A specific price point set in advance to cap potential losses. - Take Profit: A target price level at which the trader can book profits.

Utilizing Forex Trading Signals in India

- Choosing a Reliable Signal Provider: The first step is to choose a reliable and reputable signal provider. It’s essential to research and verify the provider’s track record, performance, and user reviews.

- Understanding the Signals: Traders should ensure they understand the signals provided. This includes knowing how to interpret the entry, exit, stop loss, and also take profit levels.

- Risk Management: Proper risk management is absolutely crucial when using trading signals. Specifically, this involves setting appropriate stop-loss levels and, furthermore, not risking more than a small percentage of the trading capital on a single trade.

- Demo Trading: Additionally, before using real money, traders can first test the signals on a demo account to thoroughly gauge their effectiveness and, in turn, gain confidence.

Popular Forex Signal Providers in India

Several platforms and providers offer Forex trading signals in India. Some of the popular ones include:

-

MetaTrader 4 and 5 (MT4/MT5): These platforms are widely used

by traders globally and offer a range of signal services and Traders use

automated trading options.

- TradingView: Well-known for its advanced charting tools, TradingView also provides community-driven trading signals and ideas, further enhancing its value for traders.

- ZuluTrade: A leading social trading platform, ZuluTrade allows traders to follow and also copy the trades of successful signal providers.

- ForexSignalz: This service provides trading signals specifically tailored for the Indian market, focusing on major currency pairs and key economic events.

Regulatory Considerations

In India, Forex trading is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). It’s crucial for traders to adhere to the regulatory guidelines to avoid legal complications. Some key points to consider include:

- Permitted Currency Pairs: Indian traders are only allowed to trade currency pairs that include the Indian Rupee (INR) on recognized exchanges like the NSE, BSE, and MCX-SX.

- Authorized Brokers: Traders should use brokers who are authorized by SEBI to offer Forex trading services.

- Compliance with FEMA: The Foreign Exchange Management Act (FEMA) governs Forex transactions in India. Traders must ensure their activities comply with FEMA regulations.

Advantages of Forex Trading in India

- Market Accessibility: Forex markets operate 24/7, providing traders with the flexibility to trade at any time.

- High Liquidity: In addition to being the largest financial market in the world, the Forex market is also the most liquid, thereby ensuring quick and efficient execution of trades.

- Diverse Opportunities: With a wide range of currency pairs to trade, there are numerous opportunities for profit.

- Leverage in Forex trading: enables traders to manage substantial positions using only a modest amount of capital.

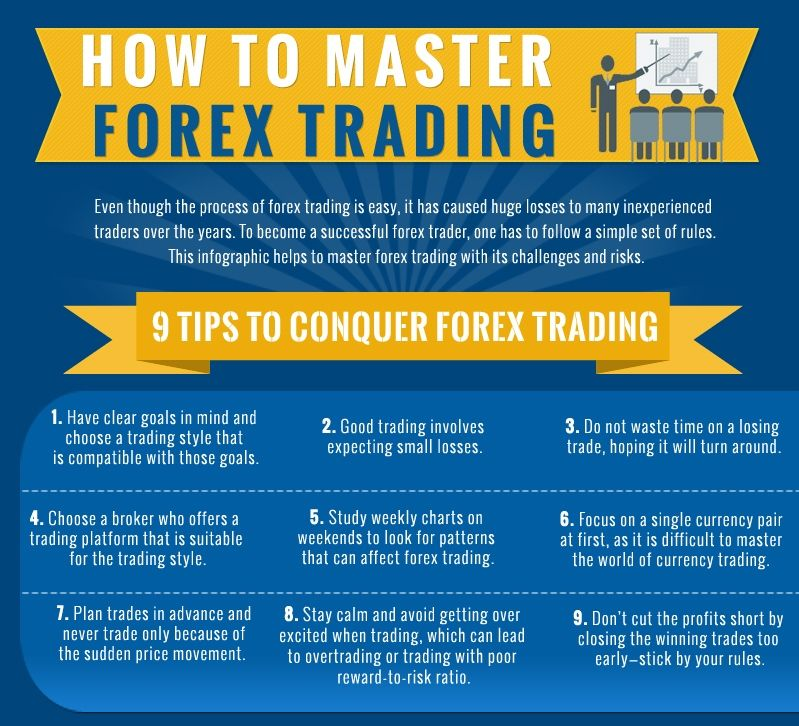

Challenges and Risks

- Market Volatility: Forex markets can be highly volatile, leading to significant price swings and potential losses.

- Risk of Over-Reliance: Over-reliance on trading signals without understanding the underlying analysis can be detrimental.

- Regulatory Restrictions: Strict regulatory guidelines in India can limit the scope of Forex trading activities.

- Scams and Frauds: Unfortunately, the growing popularity of Forex trading has also resulted in a significant increase in scams and fraudulent signal providers. Consequently, traders must exercise caution and, in addition, conduct thorough due diligence to avoid falling victim to such schemes.

Conclusion

Forex trading signals can be a valuable tool for traders in India, helping them make informed decisions and potentially enhance their trading performance. However, it is essential to choose reliable signal providers, understand the signals, implement proper risk management, and also lsocomply with regulatory guidelines. By doing so, traders can navigate the complexities of the Forex market and work towards achieving their trading goals.hieving their trading goals

FAQs on Forex Trading Signals in India

Here are some frequently asked questions about Forex trading signals in India:

1. What are Forex trading signals?

- Forex trading signals are recommendations or alerts provided by professional traders or automated systems, suggesting when to buy or sell currency pairs.

2. How can I receive Forex trading signals in India?

- You can receive Forex trading signals via SMS, email, or through dedicated trading platforms and apps.

3. Are Forex trading signals reliable?

- The reliability of Forex trading signals varies depending on the provider. It is important to choose signals from reputable sources and conduct your own analysis before making trades.

4. Do I need to pay for Forex trading signals?

- Some Forex trading signals are available for free, but more accurate and detailed signals are often offered as part of a paid subscription service.

5. Can I use Forex trading signals on any trading platform?

- Most Forex trading signals can be integrated into popular trading platforms, but it’s important to verify compatibility with your specific platform.