A Comprehensive Guide to Forex Broker Reviews in India

The Forex market, being the largest financial market globally, offers numerous opportunities for traders. In India, Forex trading[1] has gained considerable traction in recent years. However, success in forex trading largely depends on choosing the right broker. This blog provides an in-depth review of some of the top forex brokers in India, considering factors like regulations, trading platforms, fees, and customer support.

Understanding Forex Trading in India

Before delving into broker reviews, it’s essential to understand the Forex trading landscape in India. The Reserve Bank of India (RBI) regulates Forex trading in India, allowing trading only in currency pairs involving the Indian Rupee (INR). Traders can engage in Forex trading through registered brokers on recognized exchanges such as the National Stock Exchange[1] (NSE), Bombay Stock Exchange (BSE), and Multi Commodity Exchange (MCX-SX).

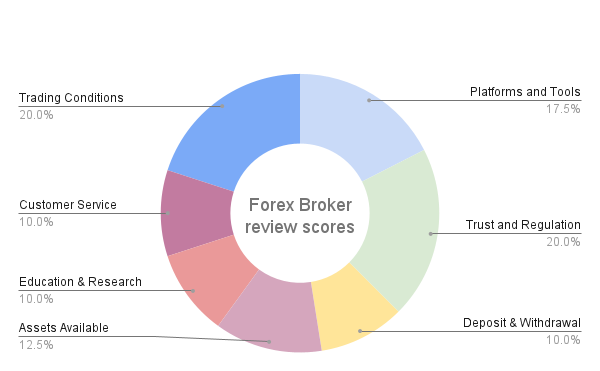

Key Factors to Consider When Choosing a Forex Broker

- Regulation: Ensure the broker is regulated by authoritative bodies like the Securities and Exchange Board of India (SEBI). This ensures the broker adheres to strict standards of transparency and fairness.

- Trading Platform: The trading platform should be user-friendly, reliable, and feature-rich. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

- Fees and Spreads: Compare the fees, spreads, and commissions charged by different brokers. Lower fees and tighter spreads can significantly impact your profitability.

- Customer Support: Efficient and responsive customer support is crucial for resolving issues and providing guidance.

- Educational Resources: Forex Broker reviews India offering educational resources can help traders, especially beginners, improve their trading skills and knowledge.

Top Forex Brokers in India

1. Zerodha

Overview: Zerodha is one of the most popular discount brokers in India, known for its transparent pricing and innovative trading platforms.

Regulation: SEBI, NSE, BSE

Trading Platform: Kite, Zerodha’s proprietary trading platform, is highly acclaimed for its intuitive interface and advanced features.

Fees and Spreads: Zerodha offers competitive fees with no brokerage on equity delivery trades and a flat fee of Rs. 20 or 0.03% per executed order for other segments.

Customer Support: Zerodha provides excellent customer support through phone, email, and live chat.

Educational Resources: Zerodha Varsity is a comprehensive educational resource offering modules on various trading and investment topics.

Pros:

- User-friendly platform

- Competitive fees

- Extensive educational resources

Cons:

- Limited to Indian markets

2. ICICI Direct

Overview: ICICI Direct, a part of ICICI Securities, is a well-established broker offering a wide range of financial services, including Forex trading.

Regulation: SEBI, NSE, BSE

Trading Platform: ICICI Direct offers a robust trading platform with features catering to both beginners and experienced traders.

Fees and Spreads: ICICI Direct’s fee structure is slightly higher, but it provides value through its comprehensive services and research.

Customer Support: Known for its efficient customer support, ICICI Direct offers assistance through phone, email, and in-person branches.

Educational Resources: The broker offers various webinars, tutorials, and articles to help traders enhance their knowledge.

Pros:

- Reputable and established broker

- Comprehensive trading platform

- Strong customer support

Cons:

- Higher fees compared to discount brokers

3. HDFC Securities

Overview: HDFC Securities is a subsidiary of HDFC Bank, offering a range of trading and investment services, including forex trading.

Regulation: SEBI, NSE, BSE

Trading Platform: HDFC Securities provides a sophisticated trading platform with real-time data and analytical tools.

Fees and Spreads: The fee structure is competitive, with transparent pricing and no hidden charges.

Customer Support: HDFC Securities offers robust customer support through multiple channels, ensuring prompt resolution of queries.

Educational Resources: The broker offers educational content, including market reports, research articles, and trading strategies.

Pros:

- Backed by HDFC Bank’s reputation

- Reliable trading[5] platform

- Good customer support

Cons:

- Slightly higher fees

4. Upstox

Overview: Upstox, backed by Ratan Tata, is a rapidly growing discount broker known for its low-cost trading services.

Regulation: SEBI, NSE, BSE

Trading Platform: Upstox offers a powerful trading platform with advanced charting tools and indicators.

Fees and Spreads: Upstox charges a flat fee of Rs. 20 per trade, making it an attractive option for cost-conscious traders.

Customer Support: Upstox provides reliable customer support through phone, email, and chat.

Educational Resources: The broker offers educational resources, including blogs, tutorials, and webinars.

Pros:

- Low-cost trading

- Advanced trading platform

- Good customer support

Cons:

- Limited research resources

5. Sharekhan

Overview: Sharekhan, one of India’s largest retail brokers, offers a wide range of trading and investment services.

Regulation: SEBI, NSE, BSE

Trading Platform: Sharekhan’s TradeTiger platform is renowned for its comprehensive features and user-friendly interface.

Fees and Spreads: Sharekhan’s fees are competitive, with detailed pricing information available on their website.

Customer Support: The broker provides excellent customer support through phone, email, and in-person branches.

Educational Resources: Sharekhan offers a variety of educational resources, including the Sharekhan Classroom and research reports.

Pros:

- Extensive trading platform

- Strong customer support

- Comprehensive educational resources

Cons:

- Slightly higher fees for premium services

Conclusion

Choosing the right Forex broker in India is crucial for a successful trading experience. Factors such as regulation, trading platforms, fees, customer support, and educational resources should be carefully considered. Zerodha, ICICI Direct, HDFC Securities, Upstox, and Sharekhan are among the top brokers offering reliable services tailored to the needs of Indian traders. By thoroughly evaluating these brokers based on the mentioned factors, traders can make an informed decision that aligns with their trading goals and preferences.

FAQs

1. What is Forex trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currency pairs in the global market. Traders aim to profit from the fluctuations in exchange rates between different currencies.

2. Is Forex trading legal in India?

Yes, forex trading is legal in India, but it is regulated by the Reserve Bank of India (RBI). Indian traders are allowed to trade only in currency pairs involving the Indian Rupee (INR) on recognized exchanges such as the NSE, BSE, and MCX-SX.

3. What should I look for when choosing a forex broker in India?

When choosing a forex broker in India, consider the following factors:

- Regulation: Ensure the broker is regulated by SEBI.

- Trading Platform: Look for a user-friendly and reliable platform.

- Fees and Spreads: Compare the fees, spreads, and commissions.

- Customer Support: Check the availability and responsiveness of customer support.

- Educational Resources: Look for brokers that offer educational materials and resources.

4. Are there any risks associated with forex trading?

Yes, Forex trading involves significant risks, including market volatility, leverage risk, and potential financial loss. It is essential to have a good understanding of the market, use risk management strategies, and only invest what you can afford to lose.

5. Which are the top Forex brokers in India?

Some of the top Forex brokers in India include:

- Zerodha

- ICICI Direct

- HDFC Securities

- Upstox

- Sharekhan