Navigating Forex Regulations in India: A Comprehensive Guide

The forex market, with its immense liquidity and global reach, offers myriad opportunities for traders and investors. However, navigating this market in India requires a keen understanding of the regulatory landscape that governs foreign exchange transactions. This blog delves into the intricacies of forex regulations in India, offering insights for both seasoned traders and newcomers.

Overview of Forex Regulations in India

In India, the forex market is regulated by the Reserve Bank of India (RBI)[1], the country’s central banking institution, and governed by the Foreign Exchange Management Act, 1999 (FEMA). The primary aim of these regulations is to facilitate external trade [2] and payments while maintaining the stability of the Indian rupee and ensuring that foreign exchange is used in a manner consistent with the country’s economic objectives.

The Foreign Exchange Management Act (FEMA)

FEMA, enacted in 1999, replaced the outdated Foreign Exchange Regulation[3] Act (FERA) of 1973. The act provides the legal framework for foreign exchange management in India and aims to promote the orderly development and maintenance of the forex market. Key provisions of FEMA include:

- Regulation of Foreign Exchange Transactions: The FEMA regulates all foreign exchange transactions, including forex trading, by requiring individuals and entities to follow the rules established by the RBI and other regulatory bodies.

- Current vs. Capital Account Transactions: FEMA distinguishes between current account transactions (such as trade-related payments) and capital account transactions (such as investments). The regulations governing these transactions differ significantly. For instance, regulations generally permit current account[4] transactions, while stricter controls govern capital account transactions.

- Permitted and Prohibited Transactions: Under FEMA, the guidelines explicitly outline both permissible and prohibited transactions. For instance, while forex trading for speculative purposes is generally restricted, transactions related to business operations and investments are, on the other hand, allowed, albeit within certain specified limits.

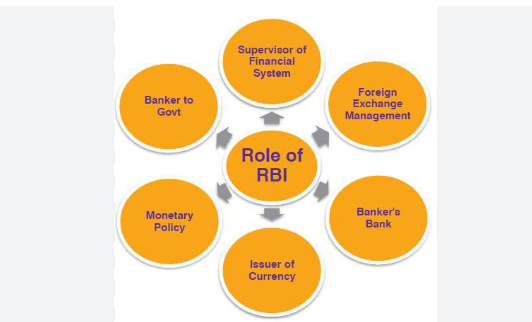

The Role of the Reserve Bank of India (RBI)

The RBI is instrumental in overseeing and managing the foreign exchange market in India. Its responsibilities include:

- Issuing Guidelines and Notifications: The RBI issues guidelines and notifications that provide detailed instructions on various aspects of forex transactions. These guidelines are designed to ensure compliance with FEMA and to maintain the stability of the forex market.

- Licensing and Monitoring: The RBI licenses entities involved in forex trading, including banks and financial institutions[5]. It also monitors their activities to ensure adherence to regulatory requirements.

- Managing Exchange Rate Stability: The RBI intervenes in the forex market to manage the exchange rate of the Indian rupee. This intervention helps to stabilize the currency and prevent excessive volatility.

Forex Trading Regulations

Forex trading in India is subject to several regulations aimed at maintaining market integrity and protecting investors. Some key regulations include:

- Currency Pairs: In India, trading in forex is limited to specific currency pairs. The most commonly traded pairs include USD/INR, EUR/INR, and GBP/INR. Trading in exotic or non-Indian currency pairs is generally restricted.

- Authorized Dealers (ADs): Forex transactions must be conducted through authorized dealers, such as banks and financial institutions licensed by the RBI. These dealers are responsible for ensuring that transactions comply with FEMA regulations.

- Leverage Limits: Indian regulations impose limits on leverage to mitigate risk and prevent excessive speculation. The leverage offered by brokers is generally lower compared to international standards.

- Over-the-Counter (OTC) Market Restrictions: While the OTC forex market is significant globally, in India, most forex trading occurs through exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). The OTC market is largely regulated to prevent unregulated trading practices.

Impact of Regulations on Forex Traders

For traders and investors, understanding the regulatory framework is crucial for compliance and successful trading. Here are some ways in which regulations impact forex trading in India:

- Compliance Requirements: Traders must adhere to the guidelines issued by the RBI and other regulatory bodies. This includes reporting transactions, maintaining records, and ensuring that authorized dealers conduct trades.

-

Risk Management: The regulatory authorities design limits on

leverage and trading practices to manage risk and protect traders from excessive

losses.While these limits may restrict trading opportunities, they also help in maintaining market stability.

- Market Access: Regulations impact the types of forex products and currency pairs available for trading. Traders need to be aware of the permissible currency pairs and trading platforms to ensure compliance.

Recent Developments and Future Trends

The forex regulatory landscape in India is continually evolving to adapt to global market trends and economic changes. Some recent developments include:

- Increased Focus on Digital Transactions: With the rise of digital financial services, the RBI has introduced measures to facilitate digital forex transactions while ensuring compliance with regulatory norms.

- Enhanced Transparency and Reporting: There is a growing emphasis on transparency and accurate reporting in forex transactions. The aim is to prevent fraud and ensure that market practices align with international standards.

- Evolving Market Access: The RBI is exploring ways to enhance market access for Indian traders, including expanding the range of permissible currency pairs and forex products.

Conclusion

Navigating the forex market in India requires a thorough understanding of the regulatory framework established by FEMA and overseen by the RBI. While these regulations aim to protect the integrity of the market and ensure economic stability, they also impact trading practices and market access. By staying informed about regulatory changes and adhering to compliance requirements, traders can effectively navigate the complexities of the Indian forex market and capitalize on its opportunities.

FAQs on Forex Regulations in India

1. What is FEMA, and why is it important?

FEMA (Foreign Exchange Management Act, 1999) is a legislative framework that governs foreign exchange transactions in India. It is essential because it regulates and facilitates external trade and payments, ensures the orderly development of the forex market, and maintains the stability of the Indian rupee.

2. Who regulates the forex market in India?

The forex market in India is primarily regulated by the Reserve Bank of India (RBI). The RBI issues guidelines, licenses entities involved in forex transactions, and monitors market activities to ensure compliance with the Foreign Exchange Management Act (FEMA).

3. What types of forex transactions are allowed in India?

In India, authorities categorize forex transactions into current account and capital account transactions. They generally allow current account transactions, such as trade-related payments, while subjecting capital account transactions, like foreign investments, to stricter controls and regulations.

4. Can individuals trade forex directly in India?

Individual traders can participate in forex trading in India, but they must do so through authorized dealers such as banks or financial institutions licensed by the RBI. Authorities restrict direct trading in the forex market to specific currency pairs and platforms.

5. Are there restrictions on leverage for forex trading in India?

Yes, there are regulations limiting the amount of leverage available for forex trading in India. The RBI imposes these limits to manage risk and prevent excessive speculation. As a result, leverage ratios in India are generally lower compared to other international markets.