INTRODUCTION

The Indian Foreign Exchange(1) (Forex) market, one of the most dynamic and rapidly evolving segments of the country’s financial sector, has witnessed significant growth over the past decade. With the rise of digital trading platforms(2) and increasing participation from both retail and institutional investors, understanding the trends shaping this market is crucial for anyone involved in forex trading(1) or financial planning in India. This blog delves into the key trends, factors influencing the market, and future prospects of the Indian Forex market.

1. Market Size and Growth

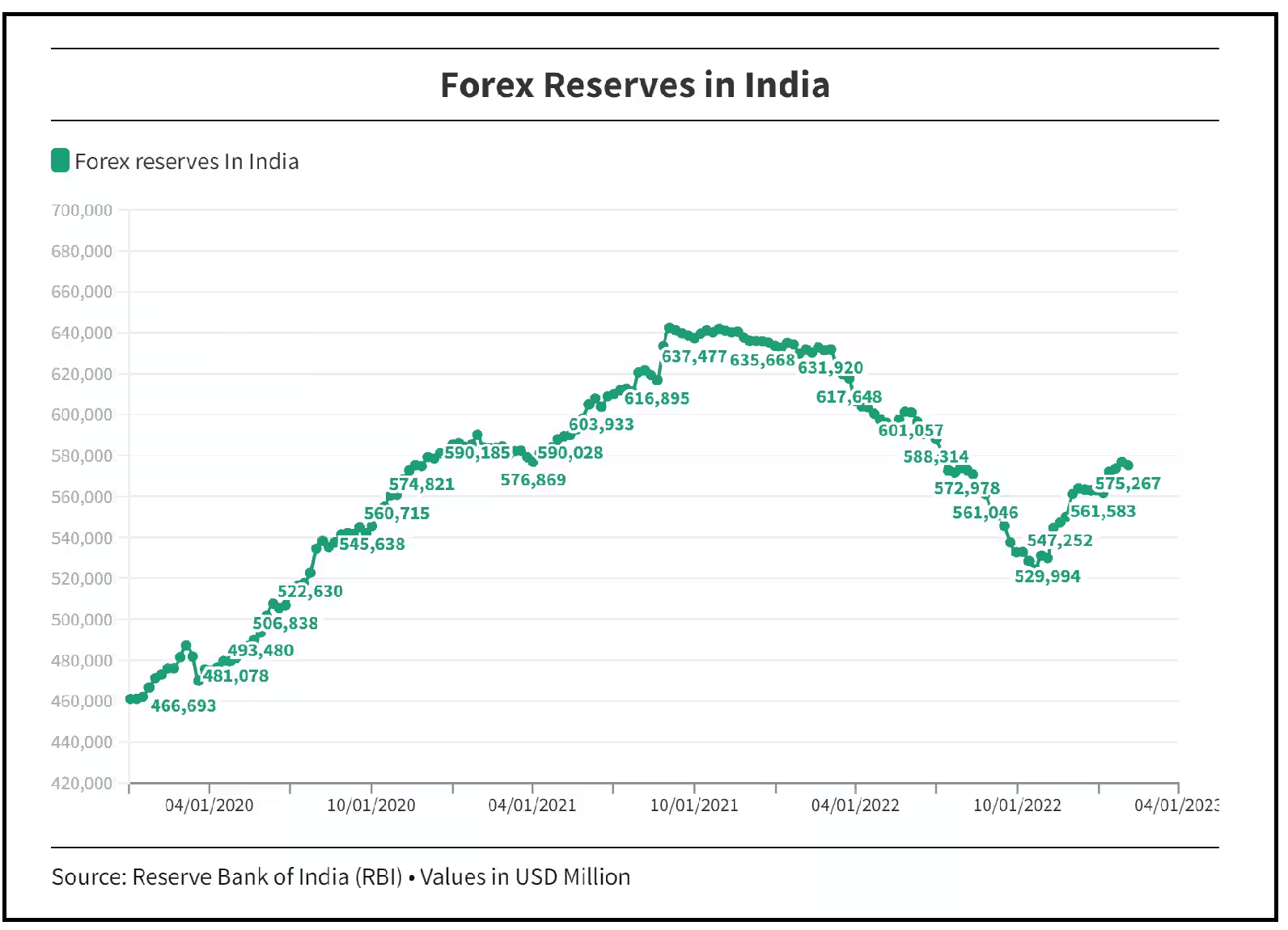

The Indian Forex market is among the largest and most liquid in the world. According to the Reserve Bank of India (RBI)(3), the daily turnover in the Indian Forex market has seen a consistent rise, with current estimates exceeding $80 billion. This growth can be attributed to several factors, including the liberalization of foreign exchange regulations, increased foreign investment, and the expanding global footprint of Indian businesses.

2. Regulatory Environment

The regulatory framework governing the Indian Forex market has undergone significant changes over the years. The RBI, along with the Securities and Exchange Board of India (SEBI)(4), plays a pivotal role in regulating forex transactions. Recent amendments, such as the introduction of the Liberalized Remittance Scheme (LRS), have facilitated greater participation from retail investors.The LRS allows Indian residents to remit up to $250,000 per financial year for various purposes, including investment in foreign assets and forex trading.

3. Technological Advancements

Technology has been a game-changer in the Indian Forex market. The advent of online trading platforms has democratized access to forex trading, enabling retail investors to participate alongside institutional players. Mobile trading apps, real-time data analytics, and algorithmic trading are some of the technological advancements that have revolutionized the market. These tools provide traders with sophisticated analytics and automated trading options, enhancing their ability to make informed decisions and execute trades efficiently.

4. Impact of Global Economic Events

Global economic events significantly impact the Indian Forex market. Factors such as geopolitical tensions, changes in global trade policies, and economic performance of major economies like the United States, China, and the European Union(5) influence currency fluctuations. For instance, the trade war between the US and China had a ripple effect on emerging markets, including India, affecting the exchange rates of the Indian Rupee (INR)(6). Similarly, the COVID-19 pandemic led to unprecedented volatility in global financial markets, including forex, as investors sought safe-haven currencies.

5. Currency Pairs and Trading Volume

In the Indian Forex market, the USD/INR pair is the most actively traded, reflecting the significant trade and investment linkages between India and the United States. Other popular currency pairs include EUR/INR, GBP/INR, and JPY/INR. The trading volume of these pairs has surged due to increased cross-border trade, foreign direct investment (FDI), and portfolio investments. Moreover, the inclusion of cross-currency futures and options in the Indian Forex market has provided traders with more avenues to hedge and speculate. Consequently, this has significantly boosted trading volumes. Additionally, the growing awareness and accessibility of forex trading platforms have contributed to this rise.

6. Participation of Retail Investors

The participation of retail investors in the Indian Forex market has grown remarkably. This shift can be attributed to better financial literacy, access to digital trading platforms, and favorable regulatory changes. Retail investors are increasingly viewing forex trading as an alternative investment avenue, complementing traditional asset classes like equities and bonds. Educational initiatives by brokers and financial institutions have also played a significant role in attracting retail investors by providing them with the necessary knowledge and tools to engage in forex trading. Furthermore, these efforts have increased investor confidence and participation. Additionally, the rise of online learning platforms and webinars has made educational resources more accessible. Consequently, more individuals are becoming active participants in the forex market.

7. Challenges and Risks

Despite its growth, the Indian Forex market faces several challenges and risks. Currency volatility, driven by external factors such as global economic conditions and domestic macroeconomic policies, poses a significant risk. Additionally, the market’s dependence on external capital flows makes it vulnerable to sudden shifts in investor sentiment. Regulatory challenges, such as stringent compliance requirements and restrictions on certain types of forex transactions, can also impede market growth.

8. Role of Financial Institutions

Banks and financial institutions are key players in the Indian Forex market. They act as market makers, providing liquidity and facilitating transactions. The interbank market, where major financial institutions trade currencies among themselves, forms the backbone of the forex market. In addition, Non-Banking Financial Companies (NBFCs) and brokerage firms have increasingly become prominent, offering forex trading services to both retail and institutional clients. Moreover, these entities are expanding their range of services, thereby attracting a broader clientele. Furthermore, their innovative platforms and competitive pricing have enhanced market accessibility. Consequently, the presence of NBFCs and brokerage firms is significantly boosting forex market participation.

9. Future Prospects

The future of the Indian Forex(2) market looks promising, driven by several positive factors. The continued liberalization of forex regulations, coupled with advancements in technology, is expected to attract more participants and increase market efficiency. The integration of the Indian market with the global economy, through trade agreements and foreign investments, will further enhance liquidity and trading volumes. Moreover, the growing awareness and participation of retail investors will add depth to the market.

10. Conclusion

The Indian Forex market is at a crucial juncture, poised for substantial growth in the coming years. While it faces challenges such as currency volatility and regulatory constraints, the overall outlook remains positive. Technological advancements, favorable regulatory changes, and increasing participation from retail investors are key drivers that will shape the future of the market. For traders and investors, staying abreast of these trends and understanding the underlying dynamics is essential for navigating the complexities of the forex market and capitalizing on the opportunities it offers.

By keeping an eye on global economic developments, leveraging technological tools, and adhering to sound risk management practices, participants in the Indian Forex market can enhance their trading strategies and achieve better outcomes. As the market continues to evolve, those who adapt and innovate will be best positioned to be thrived in by this dynamic and ever-changing landscape.

FAQ’s

Q1: What is the current state of the Indian Forex market?

A1: The Indian Forex market is robust and growing, with a daily turnover exceeding $80 billion. This growth is being driven by the liberalization of regulations, the increase in foreign investments, and the global expansion of Indian businesses.

Q2: Who regulates the Indian Forex market?

A2:The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) regulate the Indian Forex market. These bodies ensure compliance with regulations and oversee market operations to maintain stability and transparency.

Q3: What technological advancements are influencing the Indian Forex market?

A3: The market has seen significant technological advancements, including online trading platforms, mobile trading apps, real-time data analytics, and algorithmic trading. These innovations provide traders with sophisticated tools for making informed decisions and executing trades efficiently.

Q4: How do global economic events affect the Indian Forex market?

A4: Global economic events, such as geopolitical tensions, changes in trade policies, and economic performance of major economies like the US and China, significantly impact currency fluctuations in the Indian Forex market. Events like the COVID-19 pandemic have also led to increased volatility.

Q5: What are the most traded currency pairs in the Indian Forex market?

A5: The USD/INR pair is the most actively traded in the Indian Forex market, reflecting strong trade and investment links between India and the US. Other popular pairs include EUR/INR, GBP/INR, and JPY/INR.