Understanding Forex Broker Fees in India

Forex trading, or foreign exchange trading, has become increasingly popular in India, attracting a diverse group of individuals from various professional backgrounds. As more people venture into forex trading, it is crucial to understand the various fees associated with trading through a forex broker. These fees can significantly impact your overall trading costs and profitability. This blog will provide an in-depth look at the different types of forex broker fees in India, helping you make informed decisions.

Types of Forex Broker Fees

Spread

The spread represents the gap between the bid price, which is the rate at which you can sell a currency pair[1], and the ask price, which is the rate at which you can purchase it. a currency pair). Forex brokers typically earn money by charging a spread. There are two main types of spreads:

- A fixed spread, as indicated by its name, stays unchanged no matter the market conditions. This type of spread offers predictability and can be beneficial in volatile market conditions. However, fixed spreads might be higher than variable spreads during normal market conditions.

- Variable Spread: Variable spreads fluctuate based on market volatility and liquidity. During periods of high volatility, variable spreads can widen significantly, increasing your trading costs. However, they can be lower than fixed spreads during stable market conditions.

Commission Fees

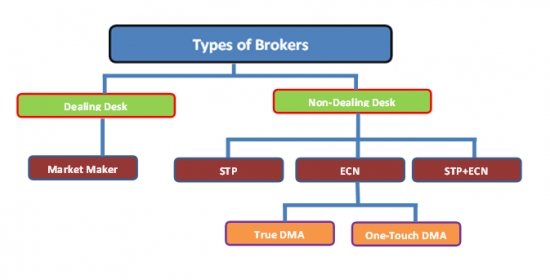

Some brokers charge a commission on each trade, either instead of or in addition to spreads. This is more common with ECN (Electronic Communication Network) brokers who provide direct access to the interbank market. Commission fees are usually a small percentage of the trade’s value. For instance, a broker might charge $5 per $100,000 traded. It is crucial to factor in commission fees when calculating the total cost of your trades.

Overnight Financing or Swap Fees

When you hold a position overnight, you may incur an overnight financing fee, also known as a swap fee. This fee is related to the interest rate differential between the two currencies in the pair[2] you are trading. If you hold a position where you are long on a currency with a higher interest rate and short on a currency with a lower interest rate, you might earn a positive swap. Conversely, if you are long on a currency with a lower interest rate, you will incur a negative swap. Swap fees are typically charged at the end of the trading day and can add up if you hold positions for an extended period.

Account Maintenance Fees

Some brokers charge a monthly or annual fee to maintain your trading account. These fees are generally nominal but can add up over time, especially if you are not actively trading. It’s important to be aware of these charges and factor them into your overall trading costs.

Deposit and Withdrawal Fees

Forex brokers might charge fees for depositing funds into your trading account or withdrawing them. The cost structure may differ based on the method of payment used. Bank transfers might have higher fees compared to electronic wallets or credit card transactions[3]. These fees can impact your profitability, especially if you frequently deposit and withdraw funds.

Inactivity Fees

Inactivity fees are charged if your trading account remains[4] inactive for a specific period, which can vary from broker to broker. These charges are intended to promote frequent trading activity. If you plan to take a break from trading, be mindful of potential inactivity fees that could erode your account balance over time.

Currency Conversion Fees

If your trading account [5] is in a different currency than your funding source, you might incur currency conversion fees. For instance, if your account is in USD and you are depositing INR, the broker will convert the funds, and a fee will likely be charged for this service. These fees can impact your overall cost, especially if you frequently deposit or withdraw funds.

Choosing the Right Forex Broker

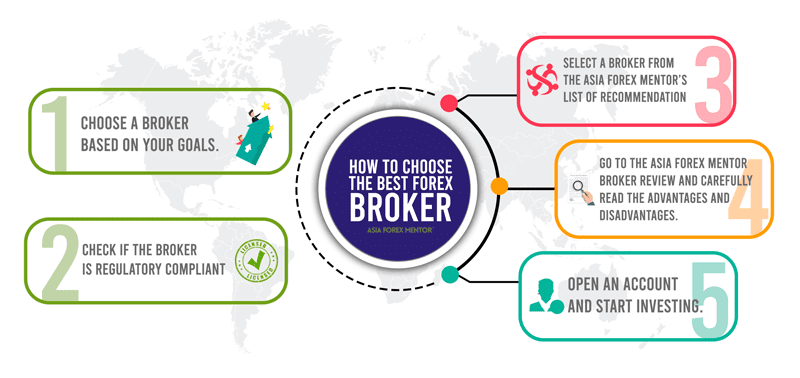

Selecting the right forex broker is crucial, given the various fees involved.

Here are a few recommendations to guide you in making a well-informed choice:

- Compare Spreads and Commissions: Evaluate the spread and commission structure of different brokers. Some brokers might offer lower spreads but higher commissions, and vice versa. Calculate the total cost per trade to understand which broker offers the best value.

- Check for Hidden Fees: Ensure you understand all the fees involved, including overnight financing, inactivity, and currency conversion fees. Thoroughly review the broker’s terms and conditions to prevent any unexpected issues.

- Regulation and Security: Ensure the broker is regulated by a reputable authority, such as the Securities and Exchange Board of India (SEBI) for Indian brokers or international bodies like the Regulatory bodies such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) offer a safeguard and ensure that brokers meet specific standards of compliance.

- Trading Platform: The trading platform should be user-friendly and offer the tools and features you need. A good platform can enhance your trading experience and efficiency.

- Customer Support: Reliable customer support is essential, especially for beginners. Ensure the broker offers good customer service and has a responsive support team.

Impact of Broker Fees on Trading Strategies

Broker fees can significantly impact your trading strategies and overall profitability. Here’s how:

- Scalping: Scalpers seek to achieve modest gains through frequent trades conducted throughout the day. High spreads and commission fees can eat into these small profits, making scalping less viable. Scalpers need to find brokers with tight spreads and low commissions.

- Day Trading: Day traders buy and sell positions within the span of a single trading day. Like scalpers, they need to be mindful of spreads and commissions. However, since they make fewer trades compared to scalpers, the impact of these fees might be less severe.

- Swing traders: typically maintain their positions for several days to several weeks. Overnight financing fees become more relevant for swing traders. A broker with competitive swap rates is beneficial for this strategy.

- Long-term Trading: Long-term traders hold positions for months to years. While spreads and commissions are less critical, overnight financing fees and account maintenance fees can accumulate over time. Long-term traders should focus on brokers with low long-term holding costs.

Conclusion

Understanding forex broker fees is crucial for any trader looking to enter the forex market in India. These fees can vary significantly between brokers and can impact your trading profitability. By comparing different brokers and their fee structures, traders can make more informed decisions and choose a broker that aligns with their trading style and goals. Always consider the total cost of trading, including spreads, commissions, overnight financing, and other potential fees, to ensure you maximize your returns.

1. What types of fees do Forex brokers in India typically charge?

- Forex brokers in India usually charge a combination of spreads, commissions, and sometimes swap fees. Some brokers may also impose deposit and withdrawal fees.

2. What is a spread, and how does it affect trading costs?

- The spread is the difference between the bid and ask price of a currency pair. It represents the broker’s profit margin and is a key factor in determining trading costs. A narrower spread generally means lower trading costs.

3. Do all Forex broker fees India charge commissions?

- Not all Forex brokers charge commissions. Some brokers operate on a spread-only basis, while others might charge a commission on top of the spread, especially on ECN (Electronic Communication Network) accounts.

4. What are swap fees, and when are they applied?

- Swap fees, also known as rollover fees, are charged when a trader holds a position overnight. These fees are based on the interest rate differential between the two currencies in the pair and can either be positive (you earn interest) or negative (you pay interest).

5. Are there any hidden fees I should be aware of?

- Some brokers may charge hidden fees such as inactivity fees, account maintenance fees, or fees for accessing premium services. It’s important to read the broker’s terms and conditions carefully.