Introduction

Forex trading, or foreign exchange trading, is a global marketplace for buying and selling currencies. This highly liquid market attracts traders worldwide, including India, due to its potential for significant profits. However, trading in the forex market in India comes with its own set of rules and regulations. Understanding the legal framework governing forex trading in India is crucial for anyone looking to participate in this market.

Overview of Forex Trading in India

Historical Background

Forex trading in India has evolved over the years. Initially, the Indian forex market was relatively closed and heavily regulated. However, with economic liberalization in the 1990s, the market gradually opened up, allowing more participation from individual and institutional traders.

Current Market Scenario

Today, Forex trading in India is still tightly regulated, with the Reserve Bank of India (RBI) playing a pivotal role in monitoring and controlling currency transactions. While the market has grown, it remains governed by stringent rules to prevent excessive speculation and protect the economy from volatile currency movements.[1]

Regulatory Bodies Governing Forex Trading in India

Reserve Bank of India (RBI)

The RBI is the primary regulatory body overseeing forex trading in India. It sets the rules and regulations under the Foreign Exchange Management Act (FEMA), ensuring that all transactions are conducted legally and transparently.

Securities and Exchange Board of India (SEBI)

SEBI also plays a significant role in regulating Forex trading, particularly in the futures market. It ensures that brokers and traders adhere to the guidelines and that the market operates fairly and efficiently.

Role of FEMA (Foreign Exchange Management Act)

FEMA is the cornerstone of India’s Forex trading regulations. It governs all foreign exchange transactions, including those related to Forex trading. FEMA aims to facilitate external trade and payments while maintaining the orderly development and management of the foreign exchange market in India.

Legal Framework for Forex Trading in India

Guidelines under FEMA

Under FEMA, only certain types of Forex trading are permitted. Indian residents can trade currency pairs that include the Indian Rupee (INR). Trading in other currency pairs[2], such as EUR/USD or GBP/JPY, is restricted unless done through recognized exchanges like the NSE or BSE.

Role of RBI in Forex Regulations

The RBI issues guidelines and circulars periodically to regulate Forex trading activities. It imposes restrictions on leveraged trading and speculative activities to minimize financial risks and protect traders and the economy.

SEBI’s Oversight on Forex Trading

SEBI regulates the Forex derivatives market; therefore, it ensures that futures contracts and other derivatives are traded within a regulated framework.SEBI’s guidelines help in maintaining market integrity and protecting investors from fraudulent activities.

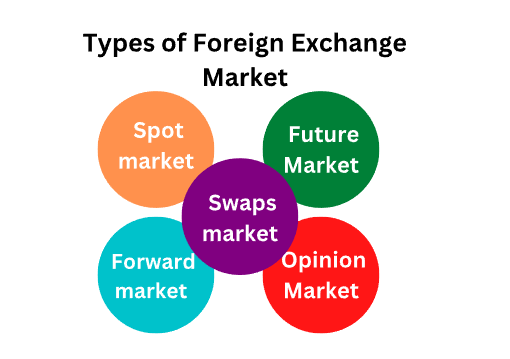

Types of Forex Trading Allowed in India

Spot Forex Trading

Spot Forex trading involves the immediate exchange of currencies at current market rates. In India, spot trading is allowed but only with currency pairs[3] that include the INR. This type of trading is less speculative and is often used for hedging purposes by businesses.

Futures Trading

Futures trading in currency pairs is permitted on recognized exchanges like the NSE and BSE. This type of trading allows traders to speculate on the future value of currency pairs, providing opportunities for profit while also carrying inherent risks.

Restrictions on Leveraged Trading

In India, leveraged trading (using borrowed funds to trade) is heavily restricted. The RBI has imposed limits on the leverage ratio to prevent traders from taking excessive risks, which could lead to significant losses and financial instability.

Forex Trading Platforms in India

Authorized Platforms by RBI

The RBI only authorizes certain platforms for Forex trading in India. These platforms are typically affiliated with recognized exchanges and adhere to the regulations set by the RBI and SEBI.

Popular Trading Platforms

Some of the popular platforms in India include Zerodha, Upstox, and Angel Broking. These platforms offer access to Forex trading within the legal framework and provide traders with the tools and resources they need to trade effectively.

Who can trade forex in India?

Eligibility Criteria

Forex trading in India is open to individuals, corporates, and institutional investors who meet the eligibility criteria set by the RBI and SEBI. Indian residents can trade, but they must comply with the regulations that restrict the types of currencies and the nature of trades.

Restrictions on Indian Residents

Indian residents are not allowed to trade in foreign currency pairs[4] directly through overseas platforms. They can only trade pairs that include the INR on Indian exchanges. This restriction is part of a broader effort to control capital flows and protect the economy.

Taxation on Forex Trading in India

Tax Implications for Forex Traders

Earnings from forex trading in India are liable for taxation. The tax system classifies these profits under “Income from Other Sources” and taxes them according to the individual’s income tax slab. Traders must maintain detailed records of all transactions for accurate tax reporting.

Reporting and Filing Requirements

Traders are required to report their Forex trading activities in their income tax returns. Neglecting to comply can lead to fines and legal repercussions. It’s advisable to consult with a tax professional to ensure compliance with the tax laws.

Risks Associated with Forex Trading in India

Market Risks

The unpredictable nature of currency markets makes forex trading inherently risky. Prices can fluctuate rapidly, leading to potential losses. Traders need to be aware of these risks and also trade within their risk tolerance levels.

Regulatory Risks

Given the strict regulations in India, there is also the risk of non-compliance. Engaging in illegal Forex trading activities, such as trading with unauthorized brokers or in restricted currency pairs, can result in severe penalties.

Penalties for Illegal Forex Trading in India

Consequences of Violating FEMA

Violating FEMA regulations can lead to hefty fines and even imprisonment. The RBI and SEBI are vigilant in monitoring illegal activities, and they have the authority to take stringent actions against violators.

Case Studies of Penalties Imposed

There have been instances where traders were penalized for illegal Forex trading activities. These case studies highlight, moreover, the importance of adhering to the regulations and the consequences of non-compliance.

Challenges in Forex Trading in India

Regulatory Challenges

The strict regulatory environment can be a challenge for Forex traders in India. The limitations on trading certain currency pairs and the restrictions on leverage can make it difficult for traders to maximize their profits.

Market Access and Liquidity

Another challenge is the limited access to global Forex markets. Indian traders are restricted to trading on local exchanges, which may not offer the same liquidity and opportunities as international markets.

Future of Forex Trading in India

Potential Changes in Regulations

There is speculation that India may gradually ease some of its Forex trading restrictions in the future. If this happens, it could open up more opportunities for traders and attract more participants to the market.

Growth Prospects

Despite the challenges, the Forex market in India is expected to grow. With increasing awareness and education about Forex trading, more individuals are likely to participate, leading to a more vibrant market.

Tips for Complying with Forex Trading Laws

Best Practices for Traders

To ensure compliance, traders should only use authorized platforms, trade within the permitted currency pairs, and avoid excessive speculation. Staying informed about the latest regulations is also crucial.

importance of Staying Updated

Forex trading laws can change, and traders need to stay updated to avoid penalties. Following official RBI and SEBI announcements and consulting with legal experts can help traders remain compliant.

Common Misconceptions About Forex Trading in India

Myth vs. Reality

There are several misconceptions about Forex trading in India, such as the belief that it is entirely illegal or that profits are not taxable. Understanding the actual laws and regulations is essential for anyone interested in Forex trading.

Conclusion

Forex trading in India is a regulated activity with specific laws and guidelines designed to protect traders and the economy. While the market offers opportunities, it also comes with challenges, particularly those related to compliance and market access. By understanding and adhering to the regulations, traders can navigate the Forex market successfully and potentially reap the benefits.

FAQs

What is the role of the RBI in forex trading in India?

The RBI

regulates forex trading in India, setting the rules and guidelines under FEMA to

ensure all transactions are legal and transparent.

Is forex trading legal in India?

Yes, forex trading is legal in

India, but it is subject to strict regulations. Only certain types of trades and currency

pairs[5] are permitted.

Can NRIs participate in forex trading in India?

NRIs can

participate in forex trading in India, but they must adhere to the guidelines set by

the RBI and FEMA.

How are profits from forex trading taxed in India?

Profits from

Forex trading are taxed under “Income from Other Sources” and are subject to the

individual’s income tax slab.

What are the risks involved in forex trading?

Forex trading is

risky due to market volatility and the strict regulatory environment in India.

Traders must be aware of these risks and trade accordingly.