Understanding Forex Trading Laws in India: A Comprehensive Guide

Forex trading, the act of buying and selling currencies, is a popular investment[1] avenue globally. In India, however, forex trading operates under a specific set of laws and regulations designed to ensure transparency, prevent illegal activities, and protect investors. This blog delves into the legal framework governing forex trading in India, providing insights into the relevant regulations, restrictions, and permissible trading practices.

1. Regulatory Framework

Forex trading in India is regulated primarily by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The RBI is responsible for overseeing the foreign exchange market to maintain economic stability, while SEBI regulates the securities markets and ensures fair trading practices.

2. Key Regulations Governing Forex Trading

a. Foreign Exchange Management Act (FEMA), 1999

The Foreign Exchange Management Act, 1999, is the primary legislation governing forex trading in India. The earlier Foreign Exchange Regulation Act (FERA) was replaced by FEMA, which aims to promote external trade and payments and facilitate the orderly development and maintenance of the foreign exchange market in India.

Key Provisions of FEMA:

- Authorized Dealers (ADs): Only banks and financial institutions[3] authorized by the RBI can deal in foreign exchange. Individuals and entities must conduct forex transactions through these authorized dealers.

- Permissible Transactions: FEMA specifies the transactions permitted in the forex market. These include payments for international trade[4], travel, education, and investments, among others.

- Prohibited Activities: Speculative trading in forex, unless through the authorized channels, is prohibited. Engaging in forex transactions outside the purview of FEMA can lead to penalties.

b. RBI Guidelines

The RBI issues various circulars and guidelines that detail the norms for forex trading, including the procedures for remittances, transactions, and reporting requirements. Key RBI guidelines include:

- Foreign Exchange Management (Export of Goods and Services) Regulations: These regulations outline the procedures for exporters and importers dealing with foreign exchange.

- Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) Regulations: These regulations pertain to foreign investments in Indian securities and vice versa.

c. SEBI Regulations Forex trading account India

For forex trading related to securities, SEBI plays a crucial role. It regulates derivatives and currency futures traded on Indian exchanges. The key regulations under SEBI include:

- SEBI (Foreign Institutional Investors) Regulations, 1995: These regulations govern foreign institutional investors in India, including their forex trading activities related to securities.

- SEBI (Currency Derivatives) Guidelines: These guidelines govern the trading of currency derivatives on recognized stock exchanges in India.

3. Forex Trading Options in India

a. Currency Futures and Options

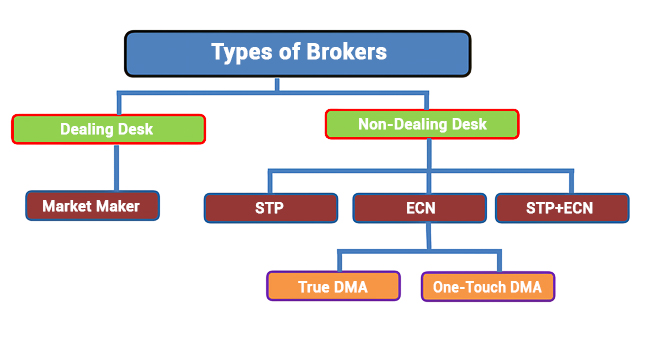

In India, currency futures and options[5] are traded on recognized exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These instruments allow investors to hedge against currency risk or speculate on currency movements. Trading currency futures and options is regulated by SEBI and must be conducted through registered brokers.

b. Over-the-Counter (OTC) Forex Market

Banks and large financial institutions in India typically conduct OTC forex trading, where transactions occur directly between parties without going through an exchange. Although this type of trading is regulated, it is less common for individual investors.

4. Restrictions and Prohibitions

a. Retail Forex Trading Forex trading account India

Retail forex trading, where individual traders speculate on currency movements, is subject to restrictions. IIn India, regulations typically limit retail forex trading to currency futures and options available on exchanges. They prohibit Indian residents from trading directly in the forex market or using offshore forex platforms.

b. Investment Limits

The RBI and SEBI limit the amount of foreign exchange individuals can trade or invest. For example, they set a cap on the foreign exchange that individuals can remit for investments in foreign markets. These limits aim to prevent capital flight and ensure the stability of the domestic forex market.

5. Compliance and Reporting

Forex traders and investors in India must adhere to strict compliance and reporting requirements. These include:

- Reporting Transactions: Individuals and entities must report certain forex transactions to the RBI or their authorized dealers. This includes transactions related to foreign investments, remittances, and currency dealings.

- Taxation: Forex trading profits are subject to taxation under Indian tax laws. Traders must report their earnings and comply with tax regulations, including the payment of capital gains tax where applicable.

6. Recent Developments Forex trading account India

The regulatory landscape for forex trading in India is continuously evolving. Recent developments include:

- Digital Forex Trading Platforms: The rise of digital trading platforms and fintech innovations has led to increased scrutiny and regulation to ensure investor protection and market integrity.

- Relaxation of Certain Restrictions: The RBI and SEBI periodically review and update regulations to adapt to changing market conditions and economic realities. This includes potential relaxations in certain restrictions to promote investment and trade.

7. Conclusion

A robust legal and regulatory framework governs Forex trading in India to ensure a fair, transparent, and stable market. Investors must navigate this complex landscape, adhering to regulations under FEMA, RBI guidelines, and SEBI regulations. By understanding and complying with these laws, traders can participate in the forex market responsibly and capitalize on opportunities within the legal boundaries.

Frequently Asked Questions (FAQs)

1. What is Forex trading?

Forex (foreign exchange) trading involves buying and selling currencies in the foreign exchange market with the aim of making a profit.

2. Is Forex trading legal in India?

Forex trading is permitted in India and is overseen by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Only certain currency pairs involving the Indian Rupee (INR) are permitted for trading.

3. What is the minimum deposit required to start Forex trading in India?

The minimum deposit varies by broker. It can range from INR 5,000 to INR 10,000 or more, depending on the broker’s policies.

4. What are the trading hours for Forex in India?

Forex trading in India typically follows the global Forex market hours. However, the trading of INR currency pairs typically runs from 9:00 AM to 5:00 PM IST, Monday through Friday.

5. What is the leverage available for Forex trading in India?

Brokers determine leverage, which generally ranges from 1:10 to 1:50 for retail traders. Higher leverage is available for professional traders.