In the fast-paced world of Forex trading, having the right tools at your disposal can significantly impact your trading success. For traders in India, Forex trading apps have become essential for executing trades, analyzing markets, and managing investments efficiently. This guide explores the best Forex trading apps available in India, highlighting their features, benefits, and how they can enhance your trading experience.

1. Understanding Forex Trading Apps

Forex trading apps are mobile platforms that allow traders to buy and sell currency pairs directly from their smartphones or tablets. These apps offer a range of functionalities, including real-time market data, charting tools, and trade execution capabilities. They are designed to provide traders with flexibility and convenience, enabling them to stay connected to the markets and make informed trading decisions from anywhere.

2. Key Features to Look for in Forex Trading Apps

When choosing a Forex trading app, consider the following features to ensure it meets your trading needs:

- User-Friendly Interface: A well-designed app with an intuitive interface can enhance your trading experience[1]. Look for apps with easy navigation, customizable layouts, and clear displays of key information.

- Real-Time Market Data: Access to live quotes, market news[2], and economic calendars is crucial for making timely trading decisions[3]. Ensure the app provides up-to-date information and fast execution.

- Advanced Charting Tools: For technical analysis, advanced charting tools with various indicators and drawing tools are essential. These features help you analyze market trends and identify trading opportunities.

- Order Execution: The app should offer reliable and fast order execution. Check if it supports various order types, such as market orders, limit orders, and stop-loss orders[4].

- Security: Security features such as two-factor authentication (2FA) and data encryption protect your account and personal information. Choose an app that prioritizes security and complies with industry standards.

- Customer Support: Access to responsive customer[5] support can be valuable if you encounter any issues. Look for apps that offer multiple support channels, such as live chat, email, and phone support.

- Educational Resources: Some apps provide educational materials, including tutorials, webinars, and market analysis. These resources can help you improve your trading skills and stay informed about market trends.

3. Popular Forex Trading Apps in India

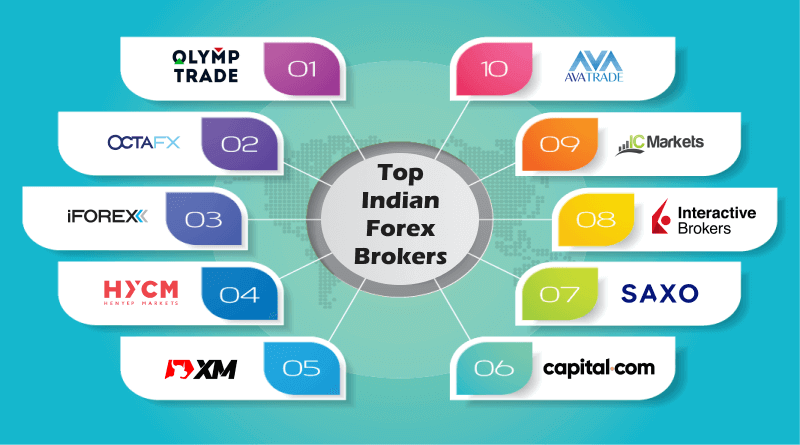

Here are some of the top Forex trading apps available in India, known for their features, reliability, and user satisfaction:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

MetaTrader platforms are among the most popular Forex trading apps globally, and they are widely used by traders in India. Both MT4 and MT5 offer advanced charting tools, a range of technical indicators, and automated trading options through Expert Advisors (EAs). MT4 is known for its user-friendly interface and robust features, while MT5 provides additional functionalities, including more timeframes, an economic calendar, and support for trading various asset classes.

ICICI Direct

ICICI Direct is a leading brokerage in India that offers a comprehensive trading app. The ICICI Direct app provides access to Forex trading along with equities, commodities, and mutual funds. It features real-time quotes, market news, advanced charting tools, and seamless order execution. The app also integrates with ICICI Direct’s research and advisory services, helping you make informed trading decisions.

Zerodha Kite

Zerodha Kite is a popular trading app in India known for its simplicity and efficiency. While Zerodha primarily focuses on equities and derivatives, it offers Forex trading services through its partner brokers. The Kite app features real-time market data, advanced charting tools, and a clean, user-friendly interface. Zerodha’s low brokerage fees and efficient execution make it a preferred choice for many traders.

HDFC Securities

HDFC Securities offers a robust trading app that supports Forex trading, among other financial instruments. The app provides real-time market data, advanced charting tools, and seamless order execution. HDFC Securities is known for its reliable customer support and integration with HDFC’s research and analysis services.

Upstox

Upstox is another prominent brokerage in India that offers a feature-rich trading app. The Upstox Pro app provides access to Forex trading, along with equities, commodities, and more. It includes advanced charting tools, real-time market data, and a customizable interface. Upstox’s competitive brokerage rates and efficient trading platform attract many traders.

E*TRADE

ETRADE is a well-established global broker with a presence in India. Their trading app offers a range of features, including real-time quotes, advanced charting tools, and a user-friendly interface. ETRADE provides access to Forex trading and a variety of other asset classes, making it a versatile choice for traders seeking a comprehensive trading experience.

4. Tips for Using Forex Trading Apps Effectively

To maximize the benefits of Forex trading apps, consider the following tips:

- Stay Informed: Regularly check market news, economic events, and updates to stay informed about factors that may impact currency markets.

- Practice Risk Management: Use risk management tools such as stop-loss orders and position sizing to protect your trading capital and manage risk effectively.

- Leverage Demo Accounts: Many apps offer demo accounts that allow you to practice trading without risking real money. Use these accounts to familiarize yourself with the app’s features and test your trading strategies.

- Monitor Performance: Regularly review your trading performance and analyze your trades to identify strengths and areas for improvement. Use the app’s reporting features to track your progress.

- Ensure Security: Protect your account by using strong passwords, enabling two-factor authentication, and being cautious of phishing attempts.

5. Conclusion

Forex trading apps have revolutionized the way traders access and engage with the Forex market in India. By offering real-time market data, advanced charting tools, and convenient order execution, these apps empower traders to make informed decisions and manage their investments efficiently. When choosing a forex trading app, prioritize features such as user experience, security, and customer support to find the best fit for your trading needs. With the right app, you can enhance your trading capabilities and stay connected to the dynamic world of forex trading.

FAQ: Forex Trading Apps in India

1. What is a Forex trading app?

A Forex trading app is a mobile application that allows traders to buy and sell currency pairs directly from their smartphones or tablets. It provides features such as real-time market data, charting tools, trade execution capabilities, and access to market news.

2. Are Forex trading apps secure?

Most reputable Forex trading apps prioritize security by implementing features like two-factor authentication (2FA) and encryption to protect user data and transactions. Always choose apps from well-regulated brokers and check for their security measures before using them.

3. Can I trade Forex with a smartphone?

Yes, Forex trading apps are specifically designed for trading on smartphones and tablets. They provide all the necessary tools for trading, including real-time data, charting, and order execution, allowing you to trade from anywhere with an internet connection.

4. What should I look for in a Forex trading app?

Key features to look for include a user-friendly interface, real-time market data, advanced charting tools, reliable order execution, strong security measures, and responsive customer support. Additionally, check if the app offers educational resources and supports various order types.

5. Are there any fees associated with Forex trading apps?

Fees can vary depending on the broker and the specific app. Common fees include spreads, commissions, and swap rates. Some apps may also charge for premium features or advanced tools. Always review the fee structure of the app and broker before opening an account.