Best AI Indicators for Forex Trading in India

Introduction

Artificial Intelligence (AI) is transforming the forex trading [1] world, providing traders with advanced tools to predict market movements, identify trends, and execute trades faster and more accurately. For Indian forex traders, AI-based indicators are becoming essential to stay competitive in the fast-paced and volatile market. These indicators help traders make data-driven decisions and automate processes that were once manual, improving both accuracy and speed.

In this article, we will explore some of the best AI indicators for Forex trading in India. We’ll explain how they work, their benefits, and how Indian traders can leverage them to enhance their trading strategies.

What Are AI Indicators in Forex Trading?

AI indicators are tools powered by machine learning [2] and deep learning algorithms that analyze vast amounts of historical and real-time market data to provide insights into price trends, entry and exit points, and market sentiment. These indicators adapt to evolving market conditions, making them more responsive and reliable than traditional indicators.

Unlike traditional Forex trading indicators, which require manual interpretation of market signals, AI-powered indicators can automate the analysis and decision-making process, ensuring that trades are executed at the optimal time with minimal emotional influence.

Top AI Indicators for Forex Trading in India

1. AI-Powered Moving Average Convergence Divergence (MACD)

MACD is a popular technical analysis [4] tool used to identify changes in the strength, direction, and momentum of a currency pair. The traditional MACD uses two moving averages, but AI-enhanced versions can adjust the parameters dynamically based on real-time market conditions.

- AI Feature: AI algorithms analyze historical data to fine-tune the moving averages used in MACD, adapting to different market phases and improving signal accuracy.

- Benefit: The AI-driven MACD offers timely and more precise signals for both bullish and bearish trends, allowing traders to enter or exit positions more effectively.

2. AI-Enhanced Bollinger Bands

Bollinger Bands are a volatility indicator that consists of a middle band (SMA) and two outer bands that adjust based on market volatility. AI-powered Bollinger Bands take this a step further by dynamically adjusting the standard deviation used in the bands, depending on real-time data analysis.

- AI Feature: AI-powered Bollinger Bands continuously analyze the price action and volatility of currency pairs, adjusting the outer bands to more accurately reflect current market conditions.

- Benefit: These adaptive Bollinger Bands allow Indian traders to identify overbought or oversold conditions with greater accuracy, improving trade entry and exit decisions.

3. Artificial Neural Networks (ANN) for Price Prediction

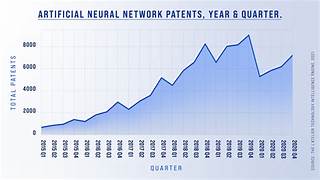

Artificial Neural Networks (ANN) are AI models designed to recognize complex patterns within large datasets. In forex trading, ANNs can process vast amounts of historical price data, identify patterns, and predict future price movements.

- AI Feature: ANN-based systems continuously learn from new data, allowing them to refine their predictions over time for greater accuracy.

- Benefit: Using ANNs, Indian traders can anticipate market movements with greater precision, helping them make data-driven decisions and capture profitable trends.

4. Support Vector Machines (SVM) for Market Classification

Support Vector Machines (SVM) is a machine learning algorithm that categorizes data into different classes. In Forex trading, SVM can classify market conditions into bullish, bearish, or neutral states based on historical price action and technical data.

- AI Feature: SVM-based indicators analyze multiple market factors, including price trends and momentum, to classify market conditions and generate trading signals.

- Benefit: Traders can use SVM-based indicators to align their trades with the prevailing market sentiment, optimizing entry and exit points in various market conditions.

5. AI-Powered Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Traditional RSI indicators use fixed overbought and oversold levels, but AI-powered RSI adapts these levels based on ongoing market conditions.

- AI Feature: The AI system adjusts the overbought and oversold thresholds by analyzing current market dynamics, improving the precision of buy and sell signals.

- Benefit: AI-powered RSI can provide more reliable signals, helping traders in India identify price reversals and avoid false breakouts.

6. Genetic Algorithms for Strategy Optimization

Genetic Algorithms (GAs) are AI-based optimization techniques inspired by the principles of evolution. In Forex trading, GAs can optimize trading strategies by evaluating various parameters and selecting the best-performing ones over time.

- AI Feature: Genetic algorithms test various combinations of parameters such as stop-loss, take-profit levels, and risk management techniques to find the most effective strategy.

- Benefit: Indian traders can use Gas to fine-tune their trading strategies and improve long-term profitability through continuous optimization.

7. AI Sentiment Analysis for Forex Trading

Sentiment analysis uses AI to analyze social media, news articles, and other textual data to determine the overall sentiment surrounding a currency pair. This helps Forex traders gauge market mood and anticipate price movements based on public sentiment.

- AI Feature: AI algorithms use natural language processing (NLP) to analyze large volumes of text and predict market sentiment, offering valuable insights into the likely direction of a currency pair.

- Benefit: Indian traders can integrate sentiment analysis into their trading strategies, allowing them to anticipate major price shifts caused by news events or market sentiment changes.

8. Fuzzy Logic for Decision-Making

Fuzzy logic is an AI approach used to make decisions in situations where data is imprecise or uncertain. In Forex trading, fuzzy logic can evaluate multiple factors and provide trade recommendations based on a range of possible outcomes rather than a single deterministic result.

- AI Feature: Fuzzy logic systems can incorporate uncertainty into decision-making, helping traders make more flexible and adaptive trading choices.

- Benefit: Traders can make more informed decisions even in volatile or uncertain market conditions, improving overall risk management.

Why Use AI Indicators for Forex Trading in India?

1. Improved Accuracy and Reliability

AI-based indicators are highly effective at analyzing complex data patterns that traditional indicators might miss. They continuously adapt to evolving market conditions, providing Indian traders with more reliable signals and predictions.

2. Faster Decision-Making

AI indicators process market data much faster than human traders, allowing for quicker decision-making and trade execution. This is especially beneficial in fast-moving markets, where timely actions can significantly impact profits.

3. Elimination of Emotional Biases

One of the biggest challenges in Forex trading is managing emotions. Fear and greed can lead to impulsive decisions, often resulting in losses. AI-based indicators remove this emotional bias by executing trades based on data and algorithms rather than human judgment.

4. Backtesting and Strategy Optimization

AI indicators allow traders to backtest strategies using historical data to determine their effectiveness. By optimizing strategies based on past performance, traders can improve the likelihood of success in live markets.

5. Automation and Reduced Effort

With AI-powered indicators, traders can automate much of their trading process. The system continuously analyzes data, generates signals, and executes trades without requiring constant monitoring. This saves time and effort for traders, allowing them to focus on strategy development and market research.

Conclusion

AI indicators are transforming the way Forex traders operate, especially in India, where the Forex market is rapidly growing. By integrating AI tools like Moving Average Convergence Divergence (MACD), Bollinger Bands, Artificial Neural Networks (ANN), and Sentiment Analysis, Indian traders can improve their trading strategies, increase accuracy, and minimize risks.

These AI-driven tools offer a significant advantage by automating decision-making, optimizing trading strategies, and providing real-time insights. As AI technology continues to evolve, it will undoubtedly become an even more integral part of Forex trading, helping Indian traders gain an edge in the competitive global market. Whether you’re new to Forex trading or an experienced trader, adopting AI indicators can lead to better, more profitable trading outcomes.ons.

FAQ

1. What are AI indicators in forex trading?

AI indicators are advanced tools powered by machine learning and artificial intelligence algorithms that analyze vast amounts of market data. They help traders make informed decisions by identifying trends, predicting price movements, and offering trade signals. Unlike traditional indicators, AI-based systems continuously adapt to changing market conditions for more accurate predictions and faster decision-making.

2. How do AI indicators benefit Indian forex traders?

AI indicators offer several key benefits to Indian forex traders:

- Enhanced accuracy: AI can process large datasets to detect patterns and trends, improving prediction accuracy.

- Faster decision-making: AI indicators analyze data in real-time, allowing traders to act quickly on market opportunities.

- Emotion-free trading: AI removes human emotional biases (fear, greed), ensuring more objective trading.

- Automation: AI systems can automate trade execution, saving time and effort while improving consistency.

3. Which AI indicators are best for forex trading in India?

Some of the best AI indicators for Forex trading in India include:

- AI-enhanced MACD (Moving Average Convergence Divergence): Used for identifying trend direction and momentum.

- AI-powered Bollinger Bands: Adjusts to market volatility and helps detect overbought or oversold conditions.

- Artificial Neural Networks (ANNs): Predict future price movements by analyzing complex patterns in market data.

- AI Sentiment Analysis: Analyzes market sentiment from news and social media, providing insights into market mood.

4. Can beginners in India use AI indicators for forex trading?

Yes, beginners in India can use AI indicators, but it’s essential to first understand the basics of Forex trading. AI indicators can help simplify the trading process by providing automated analysis and decision-making. However, beginners should start by using demo accounts and familiarizing themselves with the indicators to fully grasp how they work before committing real capital.

5. Are AI indicators suitable for all types of forex trading strategies?

AI indicators are highly adaptable and can complement various Forex trading strategies, including trend-following, scalping, and swing trading. They work by providing insights based on data analysis and optimizing trading strategies. However, it’s important to ensure that the AI indicators are set up correctly and aligned with your overall trading goals and risk management practices for optimal results.