Introduction to Forex Trading

Foreign Exchange[1] (Forex or FX) trading refers to the buying and selling of currencies with the aim of making a profit. It is one of the largest and most liquid markets in the world, operating 24 hours a day, five days a week. The Indian forex market has experienced substantial expansion in recent times, drawing in both experienced investors and novice traders.

The Regulatory Environment in India

In India, the regulation of forex trading falls under the jurisdiction of the Reserve Bank of India (RBI) and the Securities and Exchange Board of India[2] (SEBI). Indian residents are allowed to trade forex, but there are specific rules and guidelines they must adhere to. Indian traders can only trade currency pairs that include the Indian Rupee (INR). These pairs include USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading in international pairs like EUR/USD or GBP/USD is not permitted for retail investors in India.

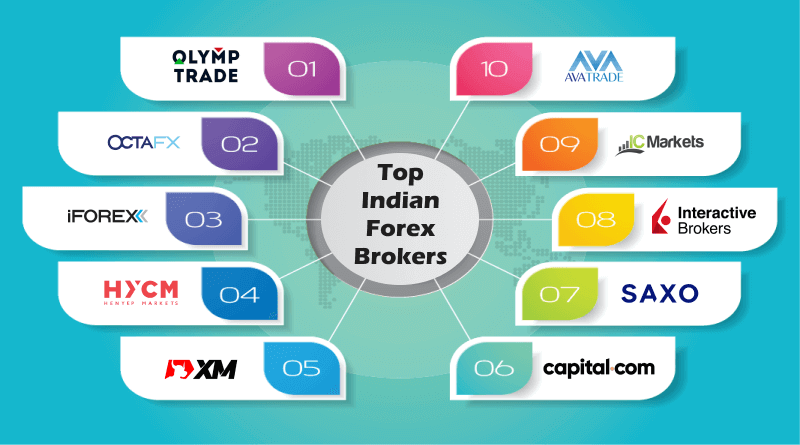

Popular Forex Trading Platforms in India

There are several forex trading platforms[1] available to Indian traders, each offering unique features and benefits. Here, we explore some of the most popular and widely used platforms:

1. Zerodha

Zerodha is one of the leading discount brokers in India, known for its user-friendly interface and low-cost trading. Through its platform, Kite, Zerodha [3] offers trading in multiple asset classes, including forex. Kite provides advanced charting tools, real-time data, and a seamless trading experience, making it a preferred choice for many Indian traders.

2. Upstox

Upstox is another prominent name in the Indian trading landscape. Known for its competitive brokerage rates and robust trading platform, Upstox Pro, it caters to both beginners and experienced traders. The platform offers advanced charting tools, technical indicators, and a user-friendly interface, ensuring a smooth trading experience.

3. 5Paisa

5Paisa is a popular discount broker offering a range of financial services[2], including forex trading. The platform is known for its low-cost trading and comprehensive research tools. The 5Paisa app is designed to cater to the needs of both novice and experienced traders, providing access to a wide range of forex trading instruments.

4. Angel Broking

Angel Broking is a well-established brokerage firm in India, offering a robust trading platform known as Angel One. The platform provides a seamless trading experience with features like advanced charting tools, real-time data, and personalized advisory services. Angel One caters to a wide range of traders, from beginners to seasoned professionals.

5. ICICI Direct

ICICI Direct is a full-service broker offering a comprehensive trading platform for forex trading. Known for its reliability and extensive research tools, ICICI Direct provides a range of trading instruments, including currency derivatives. The platform is equipped with advanced charting tools, real-time market data, and personalized advisory services.

Key Features to Consider in a Forex Trading Platform

When choosing a forex[3] trading platform, Indian traders should consider several key features to ensure they select the best platform for their needs:

1. User Interface and Experience

An intuitive interface is essential for both novice and seasoned traders. The platform should be easy to navigate, with a clean layout and intuitive design. Features like customizable dashboards, easy order placement, and quick access to trading[4] instruments enhance the overall trading experience.

2. Trading Tools and Indicators

Advanced trading tools and indicators are essential for making informed trading decisions. Look for platforms that offer a wide range of technical analysis tools, charting features, and real-time market data. These tools help traders analyze market trends, identify trading opportunities, and execute trades effectively.

3. Regulation and Security

Regulation and security are paramount when choosing a forex trading platform. Ensure the platform is regulated by relevant authorities, such as SEBI and RBI. Additionally, the platform should implement robust security measures, including encryption, two-factor authentication, and secure payment gateways[4], to protect traders’ funds and personal information.

4. Customer Support

Reliable customer support is essential, especially for new traders who may need assistance with platform features or trading strategies. Look for platforms that offer multiple support channels, including phone, email, live chat, and comprehensive FAQs or knowledge bases.

5. Costs and Fees

Consider the cost structure of the platform, including brokerage fees, spreads, and any additional charges. Compare different platforms to find one that offers competitive rates without compromising on features and reliability.

Tips for Successful Forex Trading

While having the right platform is crucial, successful forex trading also depends on several other factors:

1. Educate Yourself

Ongoing education is vital for achieving success in forex trading. Keep yourself informed about market news, economic indicators, and international events that can influence currency values. Utilize educational resources offered by trading platforms, such as webinars, tutorials, and articles.

2. Develop a Trading Strategy

A well-defined trading strategy helps in making disciplined and informed trading decisions. Whether you prefer day trading, swing trading, or long-term investing, having a strategy in place helps manage risks and improve profitability.

3. Risk Management

Effective risk management is crucial in forex trading. Set stop-loss and take-profit orders to manage potential losses and secure profits. Avoid excessive leverage and ensure that all trades are conducted within your personal risk limits.

4. Stay Updated

Keep abreast of global economic events, geopolitical developments, and central bank[5] policies that can influence currency markets. Use economic calendars and news alerts to stay informed about key events and data releases.

5. Practice Patience and Discipline

Successful forex trading requires the crucial traits of patience and discipline. Avoid emotional trading and stick to your trading plan. Analyze your trades regularly, learn from your mistakes, and continuously refine your strategies.

Conclusion

Forex trading in India offers lucrative opportunities for traders, provided they choose the right platform and adopt sound trading practices. With a variety of platforms available, traders can select one that best suits their needs and preferences. By focusing on key features such as user interface, trading tools, regulation, and customer support, traders can enhance their trading experience and increase their chances of success in the dynamic forex market.

FAQs on Forex Trading Platforms in India

1. What is Forex trading?

Forex trading, also known as foreign exchange trading or currency trading, involves buying and selling currencies on the global market. Traders aim to profit from changes in currency exchange rates.

2. Is Forex trading legal in India?

Yes, forex trading is legal in India, but it is regulated. Trading is allowed only in currency pairs that involve the Indian Rupee (INR) and a few select currencies such as USD, EUR, GBP, and JPY.

3. Which regulatory bodies oversee Forex trading in India?

The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) are the primary regulatory bodies overseeing forex trading in India.

4. What are the popular forex trading platforms in India?

Popular forex trading platforms in India include Zerodha, Upstox, 5Paisa, and ICICI Direct. These platforms offer various features, such as real-time trading, charting tools, and customer support.

5. How do I start forex trading in India?

To start forex trading in India:

- Choose a SEBI-regulated broker.

- Open a trading account with the broker.

- Complete the KYC process.

- Fund your trading account.

- Download the trading platform software or use the web-based version.

- Start trading.