Forex Trading for Professionals in India: Navigating Opportunities and Challenges

Forex trading, or currency trading, has long been a domain where professional traders leverage market movements to generate substantial profits. In India, the forex market has evolved considerably over recent years, providing both opportunities and challenges for professionals. This blog explores the intricacies of forex trading in India, offering insights into its regulatory landscape, trading strategies, and market dynamics.

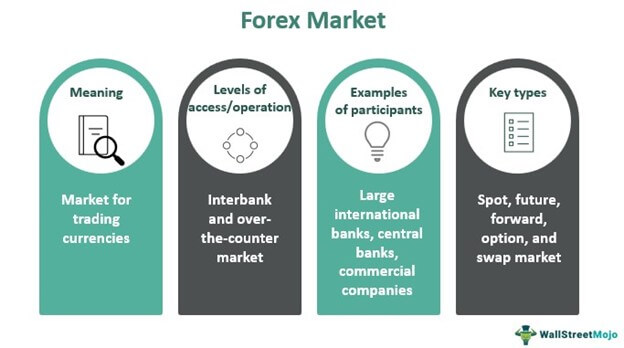

Understanding the Forex Market in India

The forex market stands[1] as the world’s largest financial market, boasting a daily trading volume that surpasses $6 trillion. In India, the forex market operates under the oversight of the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Professional traders in India engage in forex trading to take advantage of currency fluctuations[2], hedging risks, or speculating on market movements.

Regulatory Framework

1. Reserve Bank of India (RBI): The RBI regulates the forex market in India through various guidelines and regulations. It oversees foreign exchange transactions, cwith the Foreign Exchange Management Act (FEMA), 1999. The RBI’s primary role is to maintain the stability of the rupee and manage foreign exchange reserves.

2. Securities and Exchange Board of India (SEBI): SEBI, the primary regulatory authority for the securities market, also plays a role in overseeing forex trading. Although SEBI’s jurisdiction is more focused on the equity markets, it provides regulations for forex derivatives and futures traded [3]on Indian exchanges.

3. Forex Trading Platforms: In India, forex trading is facilitated through various platforms, including the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and Multi Commodity Exchange (MCX). These platforms offer forex derivatives such as futures and options.

Key Forex Trading Strategies

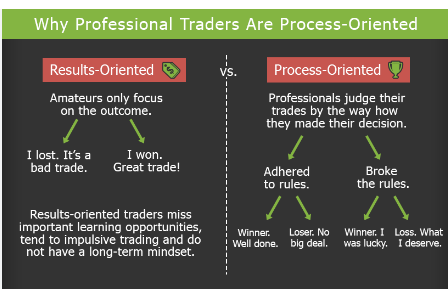

In India, professional traders utilize a range of strategies to optimize their returns. Here are some popular strategies used in the Indian forex market:

1. Technical Analysis: Technical analysis involves studying historical price data and using chart patterns, indicators, and technical tools to predict future price movements. Professionals often use tools like Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements to inform their trading decisions.

2. Fundamental Analysis: Fundamental analysis focuses on economic indicators, geopolitical events, and monetary policies that influence currency values. Professionals monitor economic reports such as GDP growth, inflation rates, and interest rate decisions to forecast currency movements.

3. Hedging: This risk management approach involves opening positions designed to counterbalance potential losses . For example, a trader might use currency futures or options to protect against adverse currency movements. Hedging is especially useful for managing exposure in international investments or trade.

4. Arbitrage: Arbitrage entails taking advantage of price differences across various markets or financial instruments. Professionals look for opportunities where the same currency pair[5] is priced differently across various exchanges or platforms and execute trades to capitalize on these differences.

Challenges Faced by Professional Forex Traders in India

1. Market Volatility: The forex market is highly volatile, with prices influenced by a range of factors including economic data, geopolitical events, and market sentiment. Professionals need to stay updated on global news and market developments to make informed trading decisions.

2. Regulatory Compliance: Navigating the regulatory landscape can be complex. Professionals must adhere to guidelines set by the RBI and SEBI, ensuring that their trading practices comply with legal requirements. Non-compliance can result in penalties or restrictions.

3. Liquidity Constraints: While the forex market is generally liquid, there can be periods of reduced liquidity, particularly in less-traded currency pairs. This can impact the ability to execute large trades at desired prices.

4. Risk Management: Implementing effective risk management practices is essential in forex trading. Professionals need to implement strategies to mitigate risks, such as setting stop-loss orders, managing leverage, and diversifying their portfolios.

Opportunities for Professional Traders

1. Expanding Market Access: The Indian forex market is becoming increasingly accessible with advancements in technology and the growth of online trading platforms. Professional traders can now access real-time market data, advanced trading tools, and global markets more easily.

2. Growing Interest in Forex Trading: As awareness of forex trading grows, more individuals and institutions are entering the market. This increased participation can lead to more trading opportunities and potentially higher liquidity.

3. Diversification of Trading Instruments: Indian exchanges offer a variety of forex trading instruments, including futures, options, and exchange-traded funds (ETFs). Professionals can diversify their trading strategies by utilizing these different instruments.

4. Integration with Global Markets: With India’s growing integration into the global economy, professionals have more opportunities to trade major currency pairs and access international markets. This integration also provides insights into global economic trends that can influence currency movements.

Conclusion

Forex trading in India offers both significant opportunities and considerable challenges for professionals. By understanding the regulatory environment, employing effective trading strategies, and managing risks, traders can navigate the complexities of the forex market and potentially achieve substantial returns. As the market continues to evolve, staying informed and adaptable will be key to success in the dynamic world of forex trading.

Forex Trading for Professionals in India: FAQs

- What is forex trading?Forex trading entails purchasing and selling currencies to capitalize on fluctuations in exchange rates.

- Is forex trading legal in India? Yes, forex trading is legal in India, but it must comply with regulations set by the RBI and SEBI.

- Which currencies can I trade in India? You can trade major currency pairs involving the INR, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR.

- What platforms can I use for forex trading in India? Forex trading in India can be done on platforms like NSE, BSE, and MCX-SX.

- What are the risks involved in forex trading? Forex trading involves risks such as market volatility, leverage risks, and regulatory changes.