Understanding Forex Trading in India: A Comprehensive Guide for Beginners

Introduction

Forex trading, abbreviated from foreign exchange trading, represents the worldwide arena for exchanging currencies. With an average daily trading volume exceeding $6 trillion, it is the largest financial market[1] in the world. In India, Forex trading has garnered significant interest over the past few years, as more individuals seek to explore this dynamic and potentially lucrative market. However, understanding the intricacies of Forex trading is crucial, especially given the unique regulatory environment in India[2]. This guide aims to provide an in-depth overview of Forex trading for beginners in India, covering the basics, legal considerations, strategies, and the challenges involved.

What is Forex Trading?

Forex trading entails swapping one currency[3] for another in an effort to gain from variations in exchange rates. Traders buy a currency pair, say EUR/USD, with the expectation that the Euro will appreciate against the US Dollar. If the trader’s prediction is correct, they can sell the currency pair at a higher price, thus earning a profit. Forex trading can be conducted via various financial instruments, including spot transactions, forwards, futures, and options.

The Regulatory Framework for Forex trading India

Before diving into Forex trading, it’s essential to understand the legal framework in India. Forex trading in India is overseen by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The RBI’s guidelines restrict Indian residents from trading in currency pairs that do not include the Indian Rupee (INR). As a result, only INR-based currency pairs, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR, are legally permitted for retail traders.

Trading in non-INR currency pairs[4] through online platforms based outside India is considered illegal. The Foreign Exchange Management Act (FEMA) governs such transactions, and violations can lead to severe penalties, including fines and imprisonment. Therefore, Indian traders must choose brokers regulated by SEBI and ensure they trade only in INR-based currency pairs.

Getting Started with Forex Trading in India

1. Choose a SEBI-Regulated Broker

Selecting a reliable and SEBI-regulated Forex broker is the first step in starting your trading journey. These brokers offer platforms that allow you to trade INR-based currency pairs. Popular SEBI-regulated brokers in India include Zerodha, HDFC Securities[5], and ICICI Direct. Ensure that the broker provides a user-friendly platform, competitive spreads, and robust customer support.

2. Open a Trading Account

Once you’ve chosen a broker, the following step is to set up a trading

account.

The process typically involves providing identification documents,

proof of address, and financial details. Most brokers offer a demo account, which is

an excellent way to practice trading with virtual money before risking real capital.

3. Fund Your Account

After your trading account is set up, you’ll need to deposit funds. Most brokers accept deposits through bank transfers, credit/debit cards, and sometimes even digital wallets. It’s advisable to start with a small amount, especially if you’re a beginner, to minimize risk.

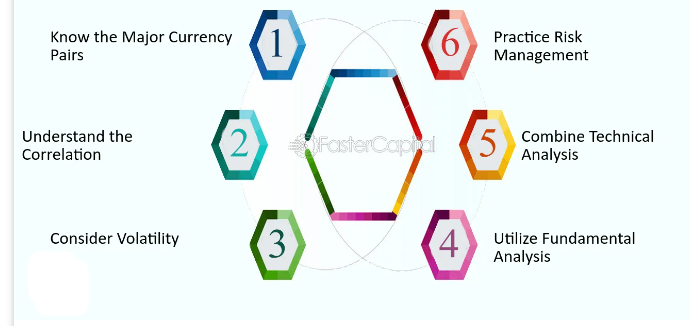

4. Learn the Basics of Forex Trading

Forex trading requires a good understanding of market analysis, including technical analysis (using charts and indicators) and fundamental analysis (considering economic factors). Educate yourself through online courses, tutorials, and webinars offered by your broker. Developing a trading strategy is crucial to success, and this often involves understanding how to read charts, identify trends, and execute trades.

5. Start Trading

With your account funded and a basic understanding of Forex trading, you can begin trading. Start by trading small positions to minimize risk. Use stop-loss orders to protect your capital, and avoid over-leveraging, as Forex trading can be highly volatile.

Forex Trading Strategies for Beginners

- Trend Following Strategy This approach focuses on recognizing and aligning with the prevailing market trend. Traders buy (go long) when the market is in an uptrend and sell (go short) when it’s in a downtrend. Tools like moving averages and trend lines are commonly used to identify trends.

- Range Trading Strategy Range trading is based on the idea that prices often move within a range, bouncing between support and resistance levels. Traders purchase close to support levels and sell near resistance levels; this tactic works well in markets without a distinct trend.

- Breakout Strategy A breakout occurs when the price moves beyond a defined support or resistance level. Traders using this strategy aim to enter the market when a price breakout occurs, anticipating that the price will continue in the direction of the breakout.

- Carry Trade Strategy The carry trade method entails borrowing funds in a currency with a low interest rate and investing them in a currency offering a higher interest rate. The goal is to profit from the difference in interest rates, known as the “carry.” This strategy is more suited for experienced traders due to its complexity.

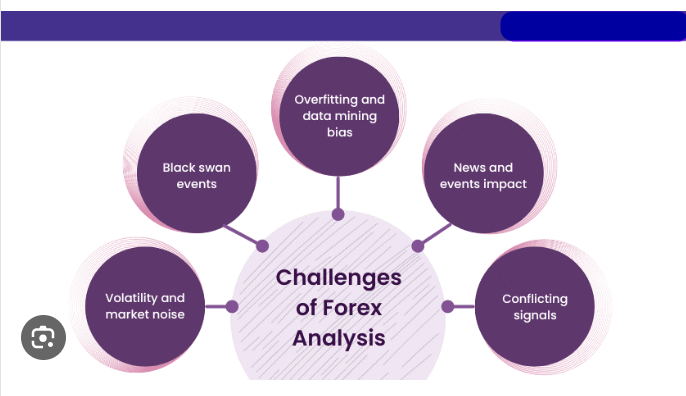

Challenges of Forex trading India

Forex trading is not without its challenges, especially in India, where regulatory restrictions limit the availability of currency pairs. Additionally, the market’s high volatility can lead to significant losses if not managed carefully. Traders must also be wary of fraudulent brokers and scams, which are prevalent in the online Forex trading space.

Another challenge is the lack of comprehensive educational resources tailored to the Indian market. While there is a wealth of information available online, much of it is geared towards international markets, which may not be entirely applicable to Indian traders. Therefore, it is crucial to seek out resources that focus specifically on the Indian Forex market.

Conclusion

Forex trading in India offers a unique opportunity to participate in the global financial markets. However, it requires a thorough understanding of the legal framework, market dynamics, and trading strategies. By choosing a SEBI-regulated broker, starting with a demo account, and gradually building your knowledge and experience, you can navigate the complexities of Forex trading in India. Always remember that Forex trading carries significant risk, and it’s essential to trade responsibly, using risk management techniques to protect your capital. With the right approach, patience, and discipline, Forex trading can be a rewarding endeavor for those willing to put in the effort

FAQs about Forex trading India

1. What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates.

2. Is Forex Trading Legal in India?

In India, forex trading is permitted but comes under regulatory oversight.You can trade currency pairs that include the Indian Rupee (INR) with other designated currencies. Trading through recognized exchanges like NSE, BSE, and MCX-SX is allowed.

What are the operating hours for forex trading in India?

Forex trading hours in India are from 9:00 AM to 5:00 PM IST, aligning with the timings of the NSE and BSE.

4. How Do I Choose a Forex Broker in India?

Choose a broker that is registered with SEBI (Securities and Exchange Board of India), offers good customer service, competitive spreads, a reliable trading platform, and educational resources.

5. What Documents Are Required to Open a Forex Trading Account?

To open a forex trading account, you’ll typically need proof of identity (such as a PAN card), proof of address (such as an Aadhar card), and bank account details.