A Comprehensive Comparison of Forex Trading Platforms in India

Forex trading, or foreign exchange trading, is becoming increasingly popular in India. With a surge in interest, the market has seen the introduction of several trading platforms, each offering unique features and benefits. Selecting the appropriate platform is vital for achieving success in forex trading. In this blog, we will compare some of the top forex trading platforms in India based on various parameters like regulatory compliance, fees, trading tools, customer support, and user interface.

Why Forex Trading?

Before diving into the platform comparison, let’s briefly understand why forex trading is gaining popularity in India:

- High Liquidity: The forex market is the largest financial market in the world, with high liquidity, allowing traders to enter and exit positions with ease.

- Leverage: Forex brokers offer significant leverage, enabling traders to control larger positions with a smaller amount of capital.

- 24-Hour Market: The forex market operates 24 hours a day, five days a week, providing flexibility for traders to engage at their convenience.

- Diverse Opportunities: Forex trading offers opportunities to trade in various currency pairs, allowing for portfolio diversification.

Key Factors to Consider When Choosing a Forex Trading Platform

- Regulatory Compliance: Ensure the platform is regulated by SEBI (Securities and Exchange Board of India) to guarantee a secure trading environment.

- Fees and Charges: Compare the brokerage fees, spreads, and other hidden charges.

- Trading Tools and Features: Look for advanced charting tools, technical analysis indicators, and ease of use.

- Customer Support: Having prompt and informed customer support is crucial for swift issue resolution.

- User Interface: A user-friendly interface enhances the trading experience[1].

Top Forex trading platforms comparison India

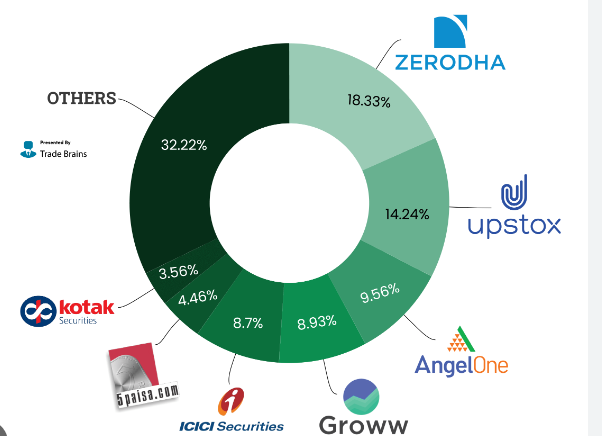

1. Zerodha

Regulation: SEBI registered

Features: Zerodha

is one of the largest retail stockbrokers in India, offering a robust platform for

forex trading. It provides advanced charting tools, comprehensive educational

resources, and a user-friendly interface. Zerodha’s platform, Kite, is known for its

fast order execution and reliability.

Fees: Zerodha offers

competitive brokerage fees with a transparent pricing structure. There are no hidden

charges, and traders can benefit from a cost-effective trading

experience.[2]

Customer

Support: Zerodha provides excellent customer support through multiple

channels, including email, phone, and chat. Their support team is quick to respond

and well-versed in their knowledge.

User Interface: Kite’s

interface is intuitive and easy to navigate, making it suitable for both beginners

and experienced

traders.[3]

2. Upstox

Regulation: SEBI registered

Features: Upstox

is a rapidly growing trading platform in India, offering a range of features for

forex traders. It provides an advanced trading platform with fast order execution,

customizable interface, and extensive charting tools.

Fees:

Upstox is known for its low brokerage fees and transparent pricing. There are no

hidden charges, making it an attractive option for cost-conscious

traders.

Customer Support: Upstox offers responsive customer

support with 24/7 availability. The support team is accessible via phone, email, and

chat, ensuring prompt resolution of queries.

User Interface:

The platform’s interface is user-friendly and can be customized to suit individual

trading preferences.

3. HDFC Securities

Regulation: SEBI registered

Features: HDFC

Securities is a trusted name in the Indian

financial market[4], providing a robust

platform for forex trading. It offers extensive research and analysis tools,

integrated banking and trading services, and a reliable trading

environment.

Fees: HDFC Securities has slightly higher fees

compared to other platforms, but it offers a comprehensive suite of services that

justify the cost.

Customer Support: The customer support team

at HDFC Securities

[5] is highly efficient, providing assistance

through phone, email, and chat.

User Interface: The platform’s

interface is well-designed, offering a seamless trading experience with easy access

to various tools and features.

4. Angel Broking

Regulation: SEBI registered

Features: Angel

Broking is a well-established broker in India, offering a feature-rich platform for

forex trading. It provides advanced charting tools, real-time market data, and a

range of technical analysis indicators.

Fees: Angel Broking

offers competitive brokerage fees with no hidden charges. The pricing structure is

transparent, making it a cost-effective choice for traders.

Customer

Support: The support team is available via phone, email, and chat,

providing prompt and reliable assistance.

User Interface: The

platform’s interface is user-friendly and intuitive, catering to both novice and

experienced traders.

5. ICICI Direct

Regulation: SEBI registered

Features: ICICI

Direct is another major player in the Indian financial market, offering a robust

forex trading platform. It provides advanced trading tools, extensive research

reports, and a reliable trading environment.

Fees: ICICI

Direct’s fees are on the higher side, but the quality of service and the range of

features offered make it a worthwhile investment for serious

traders.

Customer Support: ICICI Direct offers excellent

customer support through phone, email, and chat. The support team is both attentive

and well-informed.

User Interface: The platform’s interface is

well-designed, providing an intuitive trading experience with easy access to various

tools and features.

Conclusion

Selecting the appropriate forex trading platform is essential for achieving a successful trading journey. In India, platforms like Zerodha, Upstox, HDFC Securities, Angel Broking, and ICICI Direct offer robust features and reliable services. Each platform has its strengths and caters to different trading needs and preferences.

Frequently Asked Questions (FAQs)

- What are the best Forex trading platforms in India?

- Some of the best Forex trading platforms in India include Zerodha, Saxo Bank, ICICI Direct, HDFC Securities, Angel Broking, and Sharekhan. The choice depends on your specific needs such as brokerage fees, platform features, and customer support.

- Is Forex trading legal in India?

- Yes, Forex trading is legal in India, but it is restricted to trading currency pairs that include the Indian Rupee (INR) against other major currencies such as USD, EUR, GBP, and JPY.

- What are the risks associated with Forex trading?

- Forex trading involves several risks including market risk, leverage risk, interest rate risk, and geopolitical risk. It is important to have a sound risk management strategy in place.

- Are there any educational resources for beginners?

- Yes, many brokers provide educational resources such as webinars, tutorials, articles, and demo accounts to help beginners learn about Forex trading.